Document Retention Guide for Accounts Departments

Document Retention Guide for Accounts Departments

Managing financial records correctly is not only best practice — it is also a legal and regulatory requirement. Therefore, a clear and well-defined document retention policy for accounts departments is essential. It helps organisations remain compliant, reduce risk, improve efficiency, and control storage costs.

At Data Solutions Group, we support finance teams by helping them retain, digitise, and securely dispose of documents in line with UK legislation and recognised standards. In addition, we provide guidance to ensure your retention policy is both practical and legally sound.

Why Document Retention Matters for Accounts Teams

First and foremost, accounts departments handle some of the most sensitive and business-critical information within an organisation. As a result, retaining documents for the correct length of time is vital.

A robust retention strategy helps you to:

-

Meet HMRC and Companies Act requirements

-

Support audits, inspections, and investigations

-

Protect against financial disputes or claims

-

Reduce the risk of data breaches

-

Eliminate unnecessary storage and administrative costs

However, keeping records for too long can be just as risky as destroying them too early. Therefore, clarity and structure are key.

Key UK Regulations Affecting Financial Records

Accounts document retention is governed by several UK regulations and industry guidelines, including:

-

HMRC Requirements

-

Companies Act 2006

-

VAT Regulations

-

GDPR (UK GDPR & Data Protection Act 2018)

-

BS 10008 – Legal Admissibility of Electronic Information

Consequently, a structured retention schedule ensures compliance across all areas and reduces the risk of penalties. Moreover, it provides a clear framework for your finance team to follow.

Accounts Document Retention Periods (UK)

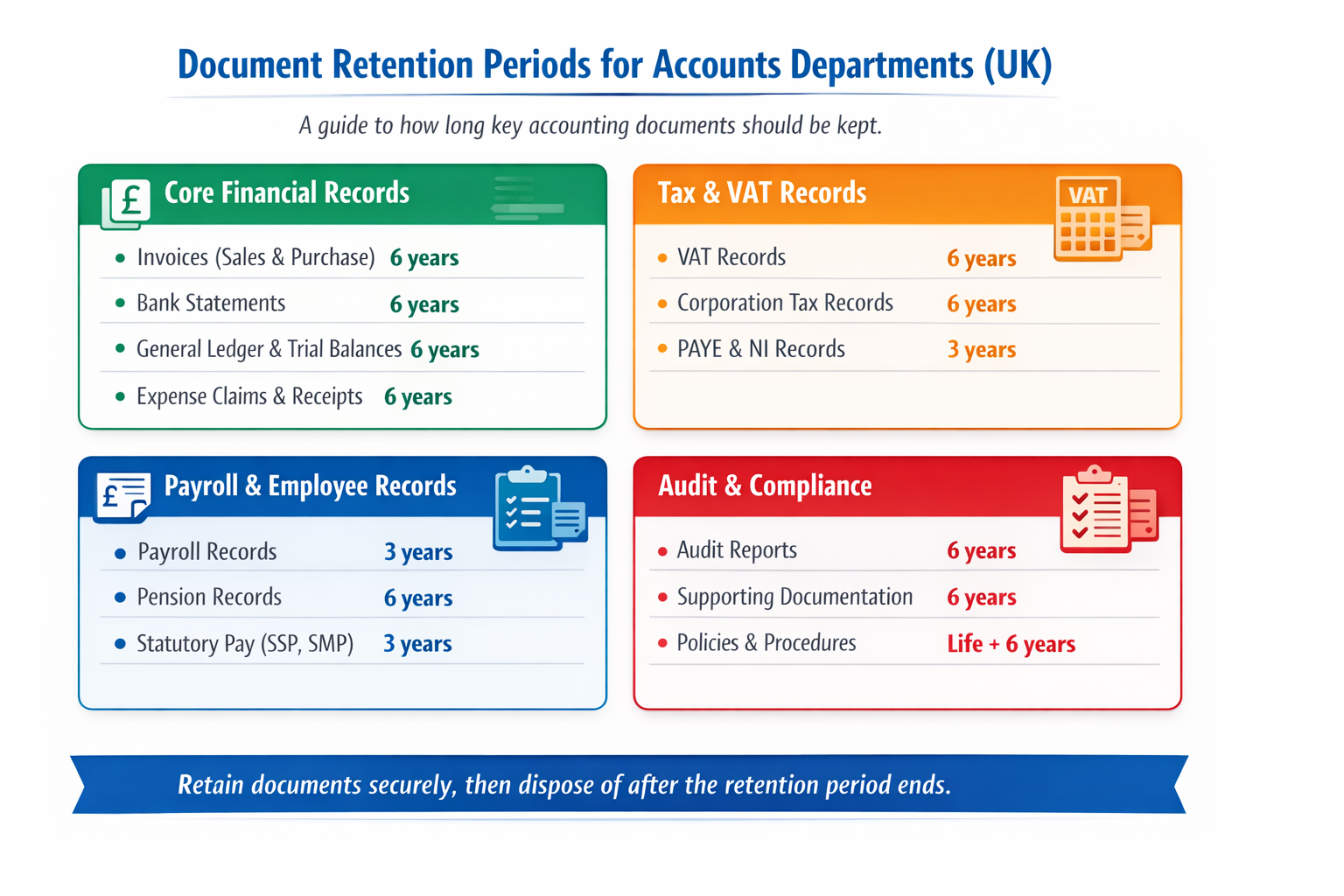

Below is a visual guide to recommended retention periods for key accounts documents. It is designed to help finance departments remain compliant and manage records efficiently.

Document Retention Periods for Accounts Departments (UK) – Produced by Data Solutions Group

Detailed Accounts Document Types and Retention Periods

| Document Type | Recommended Retention Period (UK) | Notes |

|---|---|---|

| Sales Invoices | 6 years | Required under Companies Act & HMRC for VAT & tax purposes |

| Purchase Invoices / Supplier Bills | 6 years | For VAT, audit, and accounting purposes |

| Bank Statements & Cash Books | 6 years | Supports audit trails and HMRC verification |

| Expense Claims & Receipts | 6 years | For audit and tax validation |

| Payroll Records | 3 years | Covers employee pay, deductions, and HMRC reporting |

| Pension Contribution Records | 6 years | Required for audit and regulatory compliance |

| VAT Returns & Supporting Documents | 6 years | VAT law mandates retention for at least 6 years |

| Corporation Tax Records | 6 years from the end of the accounting period | HMRC requirement |

| Audit Reports & Supporting Documentation | 6 years | Required for legal and compliance purposes |

| Financial Policies & Procedures | Life of policy + 6 years | Ensures accountability and reference for audits |

Data Solutions Group supports finance teams by helping them digitise, manage, and securely dispose of these records, ensuring full compliance with UK legislation. In addition, we provide guidance on how to optimise retention periods for efficiency.

Paper vs Digital Records – What’s Acceptable?

UK legislation allows records to be stored electronically, provided they are:

-

Accurate and complete

-

Readable for the full retention period

-

Secure and protected from alteration

-

Easily retrievable when required

Therefore, scanning paper accounts files into searchable digital formats is widely recognised as best practice. Moreover, it simplifies retention management, reduces physical storage, and ensures records are accessible whenever needed.

Benefits of Digitising Accounts Records

By digitising your finance documents with Data Solutions Group, you can:

-

Reduce physical storage space and costs

-

Improve retrieval speed during audits

-

Enhance data security and access control

-

Support remote and hybrid working

-

Ensure compliance with BS 10008 and GDPR

In addition, digital records allow automated retention and destruction scheduling, which further reduces risk. As a result, your team can focus on core finance tasks rather than manual document management.

Secure Disposal After Retention Periods Expire

Once the required retention period has passed, documents must be disposed of securely. Best practice includes:

-

Certified secure shredding

-

Full audit trails and destruction certificates

-

Clear internal approval processes

Consequently, Data Solutions Group ensures that your sensitive financial records are securely destroyed when no longer required. This helps keep your organisation compliant while protecting confidential information.

How Data Solutions Group Can Help

We support accounts teams across the UK with:

-

Secure collection and transportation of documents

-

High-resolution scanning with OCR processing

-

Accurate indexing aligned to finance workflows

-

Optional 100% on-screen quality control

-

Secure digital storage and retrieval

-

Certified document destruction after retention periods

Therefore, our team ensures financial records remain accessible, compliant, and secure throughout their lifecycle. Moreover, we tailor solutions to each organisation’s specific needs.

Speak to Us About Accounts Document Retention

If your accounts department is reviewing its document retention policy or planning to digitise financial records, Data Solutions Group can help.

📞 Contact us today to discuss compliant scanning, retention, and secure disposal solutions tailored to your organisation.

👉 Let our team guide you toward a secure, paper-light future with professional scanning and document management.

📞 Call 01625 400250 or complete our online enquiry form HERE

Data Solutions Group – Secure, Affordable & Compliant Document Scanning